Technology and innovation have come a long way. It has been so long that we have almost forgotten the dark and unforgiving history that it holds. The state of technology has not always been like this. The rapid normalization of technology over the past few decades has left catchy memorabilia in the pages of history. And history repeats.

We’ve been jumping into the NFT (Non-Fungible Token) market recently without entirely understanding the technology behind it. The market is already worth billions now. It feels too perfect to fail. Something similar happened back in the 90s. Perhaps stories of it could provide perspective as to what consequences this could hold.

Where it all began

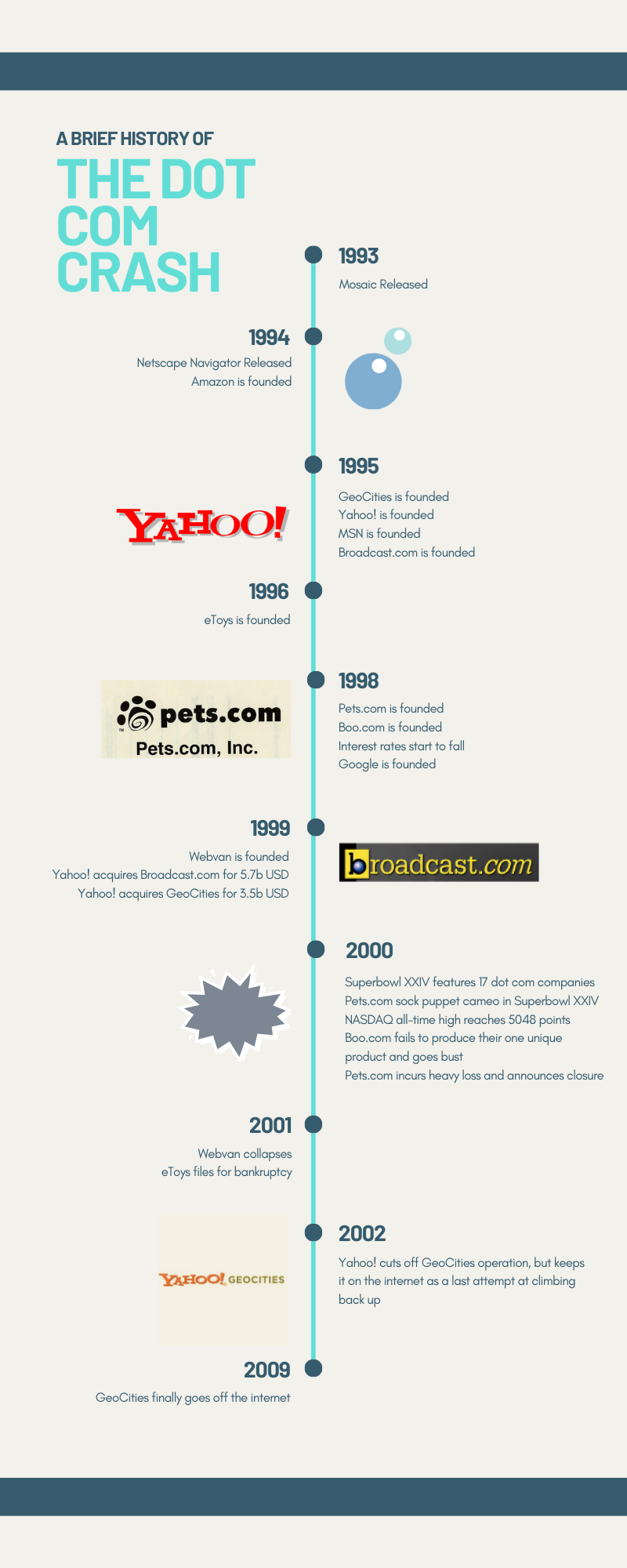

The internet today is a necessity for everyone, but it was not always like that. Back in the 90s, the internet had already existed, but it was super tricky to get on for people who didn’t know programming. By 1993, only 2.3% of the entire US population had been online.

Enter Mosaic, the first-ever interactive web browser. It could render photos along with text. And back then, this was enough to create hype. Internet movement quickly rose to 1000% within the month of its release. However, web browsers were not free yet. A particular company suddenly got determined to kick Mosaic out of the picture forever.

Netscape Communications quickly realized the market potential in this yet not-completely-understood space. The public confusion motivated them to release their own web browser Navigator. Besides being free, it was faster and even more user-friendly. Mosaic would forever be lost within the pages of history.

Netscape gained popularity rapidly. They decided to launch their IPO at NASDAQ despite not making any profit. Their stock price doubled from $35 a share to almost $70 within a day. This created sky-high expectations among investors. As for non-investors, they realized the opportunity of web-based businesses. Everyone was suddenly an entrepreneur. Although observed much later, this period has been termed as the initiation of the “dot com bubble.”

Fun fact: The name Mozilla is said to have originated from the mixture of two words, “Mosaic” and “Killer.”

The bubble is formed

People noticed the potential of getting their businesses online and started forming their own websites and going public. One slight problem, these businesses had no proper business plan, and they had gone public immediately after formation. Nobody knew whether they would ever make a profit or whether they could sustain themselves. Business investors at this point threw their entire rulebook out of the window. Businesses were going online, people were buying stocks, the companies were receiving popularity, and the investors felt like this was investment utopia. Investors jumped onto the bandwagon, and others that had no idea what was going on followed suit out of the fear of missing out.

Panic Investing: Investors started throwing money without any consideration as long as they got the chance to interact with a dot com company because the rate at which dot com stocks were rising, a day’s delay could mean the investors missing out on millions of dollars. This concept has been termed panic investing by Simon Whistler from Business Blaze.

The thing about startups is that they lack the experience to monetize and achieve a return on investment. They were overwhelmed by all the cash headed their way. They spent heavily on advertising and marketing. The entire philosophy of one Pets.com was reaching as broad a customer base as is realistically possible. A few others were not even proper businesses; they had merely a store-front, no product, a show-site and “dot com” in their names. Companies were adding dot com in their names just to become trendy. Investors had to invest blindly in startups with no idea of whether any of them would develop a prototype. Investing was basically a gamble. The bubble had already formed, and it was growing. People thought that this bubble was never going to burst.

Civilians started quitting their jobs to buy and trade stocks on a full-time basis. Companies were now investing in sizeable luxurious office spaces, thousand-dollar armchairs and extra-wild offshore parties. Companies were burning money faster than they received. The legit businesses sold their products at half the market price online, only aiming at outreach.

The philosophy of the businesses currently was, “A business that people know about is a business that sustains on its own.”

Companies built during the dot com bubble are Pets.com, Boo.com, Yahoo!, Google, Webvan, Amazon, eBay, Broadcast.com, GeoCities, Excite, among others. If you feel like you’ve never heard of a few of these, it’s because they came into existence, got very famous very fast and then lost all their valuation before fading into oblivion. However, few of these companies did make it out alive through complex business strategies. For example, Amazon CEO Jeff Bezos is said to have always had rainy day funds in place because he knew that the bubble was going to burst. The instance of entrepreneur Mark Cuban is often cited when talking about the dot com bubble. He predicted that the bubble would burst, which led him to liquidate his shares at Broadcast.com in 1999. He sold to Yahoo! and lived on as a serial investor. The saddest part of this story is that Yahoo!, although made it through the recession, could never be quite the same as it was back in its prime days.

The bubble bursts

A business can sustain in and of itself only for so long. On March 10, 2000, the NASDAQ all-time high had reached 5048 points, a massive five-fold increase over the past five years. The government increased interest on tech companies because they seemed to be invulnerable now. It is around this time when Japan went into an economic recession. Terrorist attacks were also on the rise. Investors got conscious about where they were investing their money and started panic selling.

Panic selling: External factors like socio-political conditions and government regulations led investors to believe that the companies they invested in will face difficulties in running their operations. The failure of their operations would have a severe negative impact on the investors. So, they started selling back their shares.

Panic selling rapidly destroyed the valuation of the companies. With investors pulling out their promised money from startups, companies found themselves burning through cash; and they had no idea how to deal with this because they were mostly incompetent. The United States dove head-first into a recession. Companies that boomed in a mere period of five years were reduced to nothing within the following two. Many startups would vanish, never to be heard of again, and a few would remain operational only from the shadows.

As said in the melody of the Pets.com sock-puppet, “What goes up must come down.” The rapid boom of the internet turned people overconfident. Father Time is merciless. He showed his wrath. The Sock Puppet, which once had been more popular than Mickey Mouse, today lives on in a handful of 5/6 YouTube videos. The trend of hopping on bandwagons persists, and experts opine that we could very well be in a crypto-bubble today. None of us understands what is happening, yet we invest wholeheartedly in the business because we hope to get super-rich super-fast. But that is not how businesses operate. One miscalculation could ruin lives.

Technology can offer so much, but history teaches us to analyze the opportunities before making a decision. We end this article with the example of American business tycoon Warren Buffet, who chose not to jump into the dot com bandwagon because he “was not an expert of the technology.”