The downfall of the fascist regime in Bangladesh has ushered the opportunity for reforms in banking. Over the years, banks had turned into a platform for criminal transactions. The industry was struggling not only because of the dollar deficit, but also due to non-performing loans. Thankfully, major initiatives are now being undertaken to curb inflation and purge banks of defaulters, in a bid to strengthen the economy.

Structural Changes

Gradually purchasing shares of Islami Bank Bangladesh via dummy companies, S Alam Group finally came to power in 2017. To no one’s surprise, the bank then started losing much of its profitability, as well as credibility. In the seven years following, an approximate Tk 100,000 crore has been funneled out of the bank. To help the bank regain stability, Bangladesh Bank has recently intervened and dissolved its board, replacing it a day after. Banks like Social Islami Bank Ltd. (SIBL) have also suffered the same fate. However, the conglomerate had laundered only Tk 15,000 crore from SIBL, a rookie number next to that of Islami Bank.

National Bank Ltd is another institution undergoing considerable transformation. Relentlessly plagued by defaulters, it has freshly experienced the third dissolution of its board in the span of a year. In 2021, it waived interest worth Tk. 2,310 crore on S Alam Group’s loans, on Bangladesh Bank’s request. In these irregularities, the board had already been dissolved twice, starting December 2023, to protect the interests of depositors. On 20th August, the board was terminated again, this time replaced by 3 directors and 4 independent directors.

Limited Support

The central bank recently cut liquidity support for 9 struggling banks – Islami Bank Bangladesh, Social Islami Bank, Union Bank, Global Islami Bank, First Security Islami Bank, Bangladesh Commerce Bank, Padma Bank, ICB Islami Bank, and National Bank. All of these lenders, except for the last three, are closely connected to the S Alam Group through shareholding. As such, the six affiliated banks have been restricted from disbursing loans to anyone except beneficiaries of SME or agriculture programs. Those loans too, face a cap of Tk 5 crore, and require central bank permission on amounts exceeding 5 crore. The banks are no longer allowed to take over loans from other financial institutions, and they are barred from rescheduling their other loans. As a cherry on top, Bangladesh Bank must receive monthly repayment information on their 20 largest borrowers, marking a promising step towards transparency.

In the wake of the lawlessness that ensued after August 5, Bangladesh Bank has had to impose strict limitations on withdrawals as well. Due to safety purposes, it initially instructed for a limit of Tk 1 lakh from any bank account in one day. Gradually, however, the ceiling was raised, and currently account holders can take out up to Tk. 5 lakhs per day.

Policy Alterations

An instrument of the government’s contractionary monetary policy, the interest rate plays a significant role in stabilizing inflation. The repo rate is the percentage of interest at which the central bank lends to commercial banks. In May of this year, Bangladesh Bank increased the rate to 8.5%, which has now been increased again, to 9%. It is expected that this rise in the cost of borrowing will reduce consumption and eventually aggregate demand, reining in the ever-worsening inflation. In the upcoming 2 months, the policy rate may also be hiked to 10%. But this decision must be taken with a grain of salt, as there is no guarantee that it will have a significant impact on price indices, at least without complementary fiscal policies.

While inflation and NPLs remain significant pain points for the banking sector, other issues have risen in recent times. As of right now, the industry is too saturated and requires urgent reforms in the form of mergers and acquisitions. Following the resignation of the Bangladesh Bank governor, many senior executives of other banks have left their positions, subjecting the organizations to substantial change – leadership and otherwise.

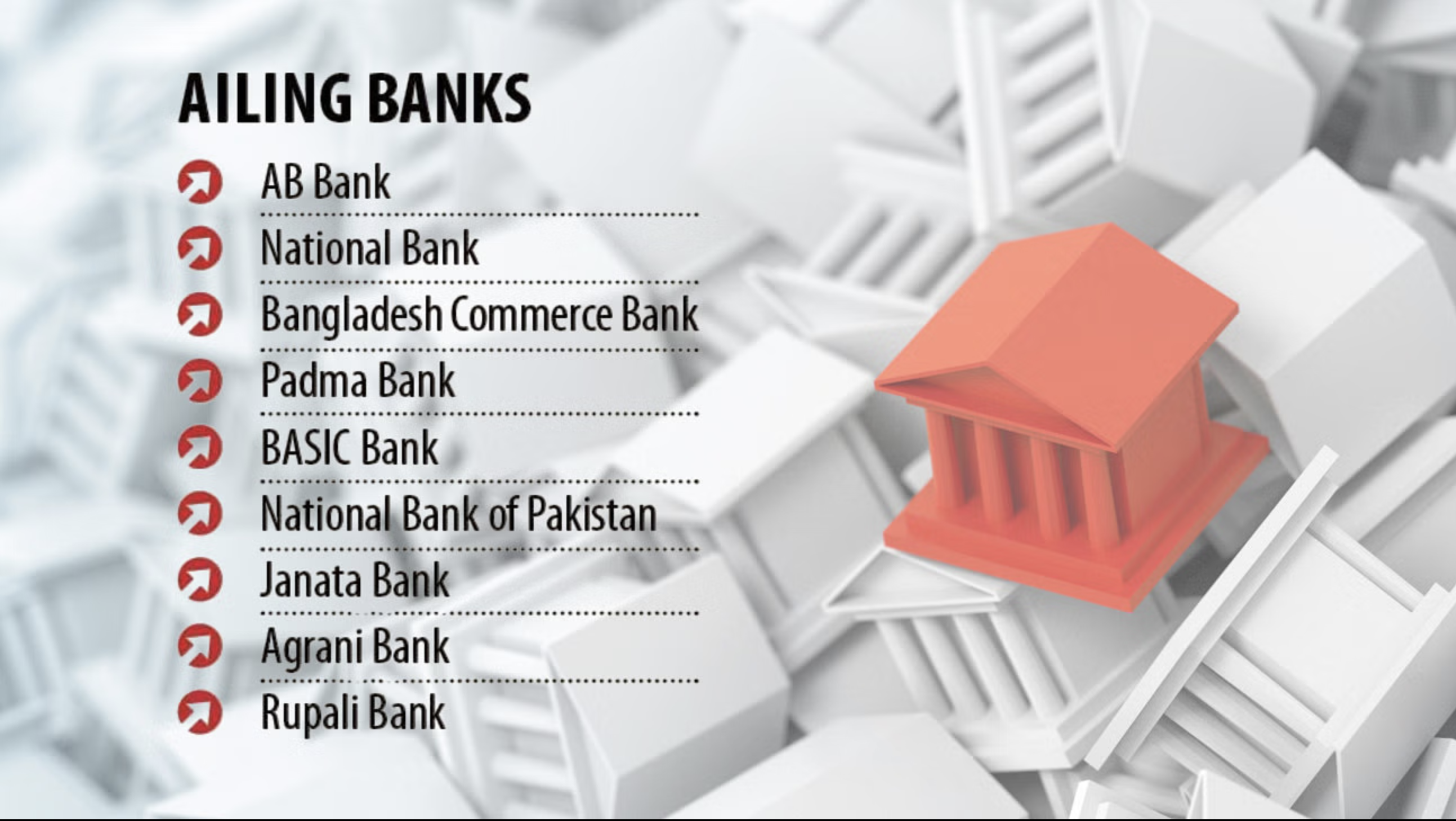

Free from the grasp of corrupt board members, these banks must now learn to cope on their own. The lenders are barely staying afloat without the support of the central bank. Reforms will not only shield account holders, but also ensure the blow to the overall economy is softened. Organizations like BASIC Bank and National Bank have previously evaded mergers, possibly due to their political connections. Therefore it now falls to the central bank to ensure that these incapacitated entities are taken care of.

The government’s significant borrowing has also added insult to injury for banks, limiting their credit facilities. As such, it has become challenging for them to extend credit facilities to CMSMEs (cottage, micro, small-and-medium enterprises), since large corporations are usually prioritized. The higher interest rate also makes life difficult for lower-income borrowers. Banks therefore also need to tackle this challenge, and ensure this customer segment does not suffer from a lack of funding.

However, not all hope is gone. In light of recent events, the interim government has announced its plans to form a banking commission. This commission will not only remedy the wrongdoings of the sector, but also provide the roadmap for much-needed change. This initiative, coupled with new boards for weak banks and amended rules, may go a long way in determining the future of the industry.